Log in to MyACC to access your 2022 1098-T form. Forms are issued no later than January 31.

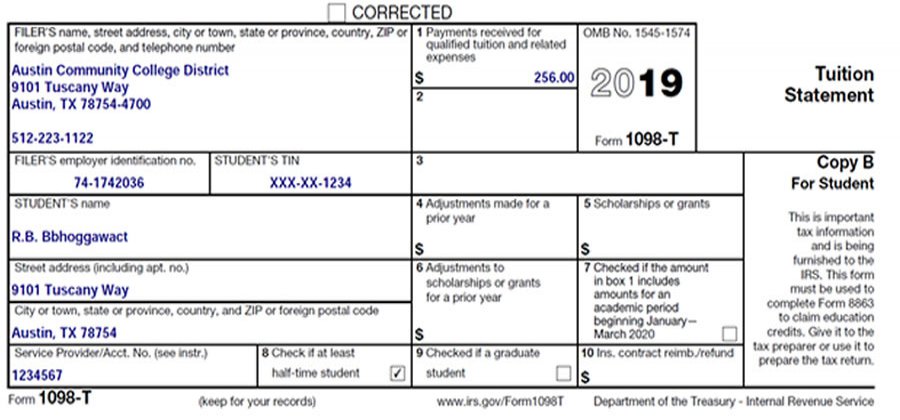

Beginning in the 2019 tax year, ACC reports adjustments to payments made for a prior year in Box 4. This includes reimbursements or refunds of qualified tuition and related expenses made in 2019 that relate to payments received that were reported for any prior year after 2002.

The 1098-T form for 2019 will also have a blank value in Box 3. In 2018 this contained a Checkbox for Change of Reporting Method. Beginning in tax year 2018, ACC started reporting payments received for qualified tuition and related expenses, and no longer reports amounts billed for qualified tuition and fees. Prior to the 2018 tax year, ACC reported reductions in charges billed for qualified tuition and related expenses.

For a payment to be reportable, it must relate to qualified tuition and related expenses billed during the same calendar year.

Disclaimer

The amount reported on the 1098-T may not be the amount you would report on your tax return. We recommend that you seek a tax professional for tax-related information. It is the responsibility of each taxpayer to determine eligibility for educational tax benefits and how to calculate them. ACC cannot advise you on how to claim the tax benefits.

Form 1098-T Tuition Statements

The IRS form 1098-T (Tuition Statement) is issued for each student enrolled and for whom a reportable transaction is made.

When is the form sent?

Electronic copies will be available to eligible students by January 31. For eligible students who did not consent to electronic delivery of form 1098-T, a hard copy will be post-marked and mailed by January 31.

Recommendations

- Verify that ACC has your correct address and Taxpayer Identification Number (such as SSN or ITIN). To update this information, visit the Update Your Information page.

- Sign up for electronic delivery of your 1098-T for access via the Self-Service Tax Information page. Select “Receive my 1098 only in electronic format” and click “Save.” You do not have to be a current student to access the 1098-T form online. You may revoke your consent at any time.

- Review your statements on the “My Account – Current Activity” page and review your 1098-T form

- Seek a tax professional for tax-related information. ACC cannot provide tax-planning assistance to students. It is up to each taxpayer to determine eligibility for the education credits and how to calculate them

- If you are required to file a Federal Income Tax Return, do so before the IRS deadline

Questions and Answers

Please review the Form 1098-T and Instructions on the IRS website.

Special Exceptions: I am an international student and did not receive Form 1098-T

If you are a non-resident alien student and do not have U.S. source income (U.S. scholarships, awards, waivers etc.) that is subject to tax, ACC is exempt from issuing a Form 1098-T to you, unless requested. Requests can be made by sending an email to [email protected].

Special Exceptions: I updated my address how do I get my 1098-T?

Sign up for electronic delivery of your 1098-T on the Self-Service Tax Information page. Select “Receive my 1098 only in electronic format” and click “Save.” Electronic copies will be available to eligible students.

If you are eligible for a form 1098-T, a hard copy may have been post-marked and mailed to your prior address.

If you have not received your hard copy at either your prior or newly-updated address, and you have not signed up for electronic delivery of your 1098-T, please send an e-mail to [email protected] to request a new copy.

Please send an e-mail to [email protected] to request a copy.

We also recommend that you sign up for electronic delivery of your 1098-T on the Self-Service Tax Information page. Select “Receive my 1098 only in electronic format” and click “Save.” Electronic copies will be available to eligible students.

How do I get a 1098-T from prior years?

We recommend that you sign up for electronic delivery of your 1098-T on the Self-Service Tax Information page. Select “Receive my 1098 only in electronic format” and click “Save.” After doing so, you can review prior year 1098-Ts from 2008 forward.

In some cases, 1098-T forms that were created manually in the past are not available online.

If you need a 1098-T for a prior year, and do not see it available after signing up for electronic delivery on the Self-Service Tax Information page, please send an e-mail to [email protected] to request a copy.

Forms for tax year 2017 and older will be created based on the old reporting method (amounts billed for qualified tuition and related expenses). Forms for tax year 2018 onward will be created based on the new reporting method (payments received for qualified tuition and related expenses).

I have an Alternate Social Security number, how do I get a 1098-T?

Due to IRS regulations, you must furnish the school a Tax Identification Number (TIN) for 1098-T purposes. The most common Tax Identification Number is the social security number or the individual tax identification number (ITIN). See the Update Your Information page for more information.

After updating your TIN, please send an e-mail to [email protected] to request a copy.

I enrolled in Continuing Education classes, am I eligible for a tax credit?

Please refer to IRS Publication 970 about the possibility of using the Lifetime Learning Credit for these types of classes.

Look for payments, charges, credits, and refunds in your statements on the “My Account – Current Activity” page.”

What is ACC's Employer Identification Number (EIN)?

ACC’s Employer Identification Number (EIN), also known as the Filer’s Federal Identification Number, is 74-1742036. For eligible students claiming education credits such as the American Opportunity and Lifetime Learning Credits, this number may be needed on IRS Form 8863.

Where do I find electronic copies of my 1098-T forms?

For eligible students who sign up for electronic delivery of the 1098-T: Self-Service Tax Information page.

How do I see what I was charged and how much I paid?

Review your statements on the “My Account – Current Activity” page

How do I update my address or taxpayer identification number (such as SSN or ITIN)?

Please visit Admissions & Records.

Email [email protected] or Call 512-223-1083.

Back to Top