| 1. |

(Repeat answer on Scantron line 26.) Immediately following World War II, the U.S.:

|

| 2. |

(Repeat answer on Scantron lines 27 and 28.) Consider each of the following statements about international economics.

1) Based on lecture, it is very common for a nation to run a balance of payments surplus or deficit. 2) If a country has a current account surplus, then it also must have a "capital account deficit" (imports of claims larger than exports of claims). 3) When claims are being exported by a country, this is called a capital inflow. Then choose which of the following is most accurate:

|

| 3. |

(Repeat your answer on Scantron line 29.) Suppose the data shows that if the price of a product rises 10% then supply rises 10% and demand falls 20%. Choose the most complete answer.

|

| 4. |

(Repeat your answer on Scantron lines 30 and 31.) As you slide down a straight line demand curve:

|

| 5. |

(Repeat your answer on Scantron lines 32 and 33.) If the incomes of potential customers rise and demand for the good declines:

|

| 6. |

(Repeat your answer on Scantron line 34.) As a result of advances in productivity, farmers can now produce their goods at a far lower cost, but the demand for agricultural goods is very inelastic. Therefore the effect of these changes has been to __________ for farmers as a group.

|

| 7. |

(Repeat your answer on Scantron line 35.) A firm produces and sells a particular good. The firm discovers the own price elasticity of demand for its good is -.25. Decide which of the following statements are correct and then choose the best answer from A) through E) below:

1) Revenue will rise as price falls. 2) This situation will not last very long, because the firm can make more profit by raising its price, which it will keep doing again and again until demand becomes elastic. (I sometimes call this "Andron's Law".) 3) Revenue will fall as price falls. 4) Revenue will fall as price rises. 5) Revenue will rise as price rises.

|

| 8. |

(Repeat your answer on Scantron line 36.) The government is considering imposing a tax on the market for Squidges and asks you whether the buyers or the sellers are going to pay a larger share of the burden of this new tax. Here is the only data you have: if the price of Squidges rises 10%, the quantity supplied rises 10% and quantity demanded falls 20%. Choose the most complete answer.

|

| 9. |

(Repeat your answer on Scantron lines 37 and 38.) The numbers in the table represent current prices of four goods in two different nations, Rahrah and Goofonia. Each price is expressed in the local currency of that country, which is the "rah" in Rahrah and the "goofus" in Goofonia. These two countries have never traded with each other, but now they begin to trade. There will be no barriers to trade, no transport costs and no tariffs. Here are several statements which may or may not be true. Decide about each statement and then select the best answer below.

1) Good 4 definitely will be exported from Rahrah to Goofonia. 2) Goods 1, 2 and 3 will all begin to be traded from Goofonia to Rahrah. 3) After trade has built up to its eventual equilibrium level, the equilibrium trade-currency ratio (measured in units of rahs per goofus) will definitely be less than 1. 4) After trade has built up to its eventual equilibrium level, the equilibrium trade-currency ratio (measured in units of rahs per goofus) will definitely be greater than 1/2. 5) If a foreign exchange market comes into existence, the equilibrium exchange rate (measured in units of rahs per goofus) will definitely be at least as large as 1, and no larger than 3, but we cannot be more accurate without more data.

|

| 10. |

(Repeat your answer on Scantron line 39.) Evaluate each of the following statements having to do with international flows of capital and international flows of goods, then select the best answer from among A though D below.

1) As a practical matter, financial claims cannot move between nations as quickly as goods. That is why the foreign exchange markets are linked more tightly to the trade currency exchange rates of internationally traded goods than internationally traded claims. 2) Since a country can have an imbalance between the import and export of claims (in other words, can run a capital account surplus or deficit) therefore a country can run a surplus or deficit in its balance of payments.

|

| 11. |

(Repeat your answer on Scantron line 40.) Evaluate each of the following statements having to do with the international foreign exchange markets, then select the best answer from the lettered choices below.

1) Without the foreign exchange markets (by which citizens all over the world acquire the foreign money they need for purchases of the goods of foreign nations) international trade would not be possible. 2) The exchange rates in the international foreign exchange markets track the trade currency ratios of internationally traded claims more closely than the trade currency ratios of internationally traded goods.

|

| 12. |

(Repeat your answer on Scantron line 41.) Evaluate each of the following statements having to do with international trade, then select the best from the lettered choices below.

1) There are no "pareto gains" from international trade of goods between nations, because the process of international trade always creates losers, as well as gainers, in both countries. 2) Suppose a small country began international trade of goods with a large, economically advanced country such as the United States, and suppose further that neither country was permitted to impose protective tarriffs. Then most of the pareto gains from international trade would be captured by the larger, more advanced country and in fact, the smaller country might not benefit at all.

|

| 13. |

(Repeat your answer on Scantron line 42.) Assume that the income elasticity of demand for a good is greater than one. Then evaluate each of the following statements and choose the best answer from among the lettered choices below.

1) The good is a luxury good. 2) The good is a necessity. 3) The good is a normal good. 4) The good is an inferior good.

|

| 14. |

An effective price ceiling:

|

| 15. |

If the Smith family would be willing to sell their house for $185,000, but they in fact sell it for $225,000, they will receive:

|

| 16. |

(Repeat answer on Scantron lines 43 and 44.) The burden of a tax is:

|

| 17. |

Dead weight loss refers to the loss of _______________ caused by a tax.

|

| 18. |

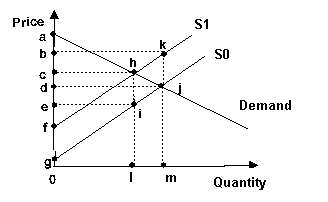

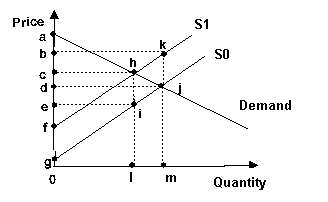

Hard Question. Refer to the graph above. Assume the market is initially in equilibrium at point j in the graph. If government imposes a per-unit tax equal to the distance between point k and point j in the graph, and buyers collect and send in the money from the tax, equilibrium price will:

|

| 19. |

Refer to the graph above. After the imposition of an effective price floor at Pf, producer surplus is shown by areas:

|

| 20. |

(Repeat answer on Scantron line 45.) Public choice economists argue that rent-seeking activities:

|

| 21. |

(Repeat answer on Scantron line 46.) Social security taxes are:

|

| 22. |

(Repeat answer on Scantron line 47.) The U.S. economy is currently financing its trade deficit by:

|

| 23. |

(Repeat answer on Scantron line 48.) Trade adjustment assistance:

|

| 24. |

(Repeat answer on Scantron line 49.) Countries restrict international trade for all of the following reasons except:

|

| 25. |

(Repeat answer on Scantron line 50.) The term most-favored nation (MFN) refers to a country that will:

|

Answer Key

| 1. | C |

| 2. | D |

| 3. | D |

| 4. | D |

| 5. | E |

| 6. | E |

| 7. | B |

| 8. | B |

| 9. | B |

| 10. | D |

| 11. | B |

| 12. | D |

| 13. | A |

| 14. | B |

| 15. | B |

| 16. | A |

| 17. | C |

| 18. | E |

| 19. | A |

| 20. | C |

| 21. | D |

| 22. | A |

| 23. | B |

| 24. | B |

| 25. | B |