Exam 2 several versions Student Name: __________________________________

Microeconomics

Exam Dates: 9th week

Instructions:

I) On your Scantron card you must print three things:

1) Print your full name clearly;

2) Print the day and time of your section (for example MW 1:25);

3) Notice the number I have written in ink in the upper right corner of your test? Write that number on the Scantron card. (This number tells me which version of the test you have. Without it your test cannot be graded properly and you get no credit for your answers.)

II) Answer on your Scantron card, using a #2 pencil.

III) Warning: SOME QUESTIONS MUST BE ANSWERED SEVERAL

TIMES! Such questions will begin with a phrase such as this:

Repeat this answer on lines 37, 38 and 39.

Remember to do it!

IV) You must turn in this written exam along with your Scantron card to get credit for your Exam score.

=====================================================================

Questions:

| 1. |

If the supply curve is vertical the burden of a tax on suppliers is borne:

| A. |

entirely by the suppliers. |

| B. |

entirely by the consumers. |

| C. |

mostly by the suppliers, and partly by the consumers, if the demand curve is inelastic. |

| D. |

partly by the suppliers, and mostly by the consumers, if the demand curve is elastic. |

|

| 2. |

(Repeat answer on line 25.) An important difference between price ceilings and taxes is that price ceilings __________ and taxes __________.

| A. |

create potential shortages; do not |

| B. |

create potential shortages; result in no dead weight loss |

| C. |

result in dead weight loss; do not |

| D. |

result in dead weight loss; create potential shortages |

|

Reference: Figure 7-20

| 3. |

(Repeat answer on line 26.) Refer to the graph above. There will be a shortage of soldiers if the wage is set equal to:

|

| 4. |

(Repeat answer on Scantron lines 27 and 28.) If the demand curve is not at all responsive to price the burden of a tax on suppliers is borne:

| A. |

entirely by the suppliers. |

| B. |

entirely by the consumers. |

| C. |

mostly by the suppliers, and partly by the consumers, if the demand curve is inelastic. |

| D. |

partly by the suppliers, and mostly by the consumers, if the demand curve is elastic. |

|

| 5. |

(Repeat answer on Scantron line 29.) "Andron's Law"

1) states that any tax which raises significant revenue is bound to be inefficient.

2) states that no seller will face an inelastic demand curve.

3) states that the income elasticity of demand declines as you move down a straight line demand curve.

| A. |

Only statement 1 is correct. |

| B. |

Only statement 2 is correct. |

| C. |

Only statement 3 is correct. |

| D. |

All three statements are correct. |

| E. |

None of the statements are correct. |

|

Reference: Figure 7-10

| 6. |

(Repeat answer on Scantron line 30.) Refer to the graph above. Initial market equilibrium is at point H. When government imposes a per unit tax, supply shifts from S0 to S1. The effect of this tax is to:

| A. |

raise the total cost per unit paid by buyers from D to C. |

| B. |

raise the total cost per unit paid by buyers from C to A. |

| C. |

raise the equilibrium quantity sold from E to F. |

| D. |

raise the total cost per unit paid by buyers from C to B. |

|

| 7. |

(Repeat answer on Scantron line 31.) If a consumer is willing to pay as much as $5 for a hot dog that actually costs $1.50, then the amount of consumer surplus resulting from the purchase of the hot dog would be:

|

| 8. |

(Repeat your answer on Scantron lines 32 and 33.) Assume that the income elasticity of demand for a good is greater than one. Then evaluate each of the following statements and choose the best answer from among the lettered choices below.

1) The good is a luxury good.

2) The good is a necessity.

3) The good is a normal good.

4) The good is an inferior good.

| A. |

Only Statements 1 and 3 are correct. |

| B. |

Only Statement 1 is correct. |

| C. |

Only Statement 3 is correct. |

| D. |

Only Statement 2 is correct. |

| E. |

Only Statement 4 is correct. |

|

Reference: Impact of tax on market

| 9. |

(This might be tricky) Refer to the graph above. Assume the market is initially in equilibrium at point j in the graph. If government imposes a per-unit tax equal to the distance between point k and point j in the graph, and buyers collect and send in the money from the tax, "the market price" will:

|

| 10. |

(Repeat your answer on Scantron lines 34 and 35.) The government is considering imposing a tax on the market for Squidges and asks you whether the buyers or the sellers are going to pay a larger share of the burden of this new tax. Here is the only data you have: if the price of Squidges rises 10%, the quantity supplied rises 10% and quantity demanded falls 20%. Choose the most complete answer.

| A. |

Then sellers will bear more of the burden than buyers. |

| B. |

Then buyers will bear more of the burden than sellers. |

| C. |

Then buyers and sellers will share the burden equally. |

| D. |

Since we have not been told who will be "paying" the tax, we cannot say who will bear the burden. |

| E. |

There will be no burden of this tax, since neither supply nor demand are "elastic". |

|

| 11. |

(Repeat your answer on Scantron line 36.) A firm produces and sells a particular good. The firm discovers the own price elasticity of demand for its good is -.25. Decide which of the following statements are correct and then choose the best answer from A) through E) below:

1) Revenue will rise as price falls.

2) This situation will not last very long, because the firm can make more profit by raising its price, which it will keep doing again and again until demand becomes elastic. (I sometimes call this "Andron's Law".)

3) Revenue will fall as price falls.

4) Revenue will fall as price rises.

5) Revenue will rise as price rises.

| A. |

Statements 1, 4 and 5 are true. |

| B. |

Only Statements 2, 3 and 5 are true. |

| C. |

Only Statements 3 and 5 are true. |

| D. |

Only Statements 1 and 4 are true. |

| E. |

Only Statement 2 is true. |

|

| 12. |

(Repeat your answer on Scantron line 37.) Since both supply curves and demand curves tend to be less elastic in the short run than in the long run:

1) The burden of a tax tends to fall more heavily on the buyers in the short run but shift more onto the sellers in the long run.

2) The burden of a tax tends to fall more heavily on the sellers in the short run but shift more onto the buyers in the long run.

3) The tax is definitely more efficient in the long run than the short run.

4) The tax is definitely more efficient in the short run than the long run.

5) A given tax will definitely raise more taxes revenue in the short run than the long run.

6) A given tax will definitely raise more tax revenue in the long run than the short run.

Choose the best answer:

| A. |

Statement 1 is definitely true. |

| B. |

Statement 2 is definitely true. |

| C. |

Statements 4 and 5 are true, and neither 1 nor 2 are true. |

| D. |

Statements 3 and 6 are true, and neither 1 nor 2 are true. |

| E. |

Statements 1, 3 and 6 are true. |

|

| 13. |

(Repeat your answer on Scantron line 38.) As you slide down a straight line demand curve:

| A. |

The own price elasticity of demand definitely rises. |

| B. |

Both A) and E) are correct. |

| C. |

The elasticity of supply definitely rises. |

| D. |

No other answer is correct. |

| E. |

The income elasticity of demand definitely falls. |

|

| 14. |

(Repeat your answer on Scantron line 39.) Suppose the data shows that if the price of a product rises 5% then quantity supplied rises 10% and quantity demanded falls 30%; and if income rises 5% quantity demanded rises 15%. Evaluate the following, then choose your answer:

1) The own price elasticity of supply is 1/2.

2) The own price elasticity of supply is 2.

3) The own price elasticity of demand is 6 (technically -6).

4) The own price elasticity of demand is 1/6 (technically -1/6).

5) An economist would say the good definitely is a luxury good.

Choose the best answer.

| A. |

Only statements 1, 4 and 5 are correct. |

| B. |

Only statements 2, 3 and 5 are correct. |

| C. |

Only statements 2 and 3 are correct, and statement 5 may be either true or false |

| D. |

Only statements 1 and 4 are correct, and statement 5 may be either true or false |

| E. |

Only statement 5 is correct. |

|

| 15. |

Consider each of the following statements about the "minimum wage laws" as discussed in lecture.

1) The minimum wage law results in higher income for those teenagers who are able to find work, but lower incomes for many teenagers who become unemployed because of the law.

2) The minimum wage law makes it easier for smart, reliable, well connected teenagers to steal jobs from poorly educated teenagers and minority teenagers.

3) The minimum wage law is an example of a price floor.

Then choose which of the following is most accurate:

| A. |

Only statements 1 and 3 are true. |

| B. |

Only statements 2 and 3 are true. |

| C. |

All the statements are true. |

| D. |

Only statements 1 and 2 are true. |

| E. |

None of the statements are true |

|

| 16. |

Assuming elasticity of supply is the same for all goods, sellers would bear the smallest burden of a 10% tax on which item?

| A. |

Beef with a price elasticity of demand of 0.62. |

| B. |

Pork with a price elasticity of demand of 0.73. |

| C. |

Chicken with a price elasticity of demand of 0.32. |

| D. |

Fish with a price elasticity of demand of 0.12. |

|

| 17. |

(Repeat answer on Scantron lines 40 and 41.) Consider each of the following statements about taxes.

1) If the buyer sends the tax proceeds to the government, the market price of the good (dollar per unit passing from buyer to seller) will be higher than if the seller sends tax to the government.

2) If you want a tax to be "efficient" (as discussed in lecture), pick a market in which both supply and demand are as inelastic as possible.

3) In lecture we have said that if you wish the sellers to bear the burden of a tax, it is important to be sure that the seller, not the buyer, collects the tax revenue and sends it to the government.

Then choose which of the following is most accurate:

| A. |

Only 1 and 3 are true. |

| C. |

Only 2 and 3 are true. |

| D. |

Only 1 and 2 are true. |

|

| 18. |

(Repeat answer on Scantron line 42.) Consider each of the following statements about price ceilings and price floors.

1) Price ceilings create shortages and price floors create surpluses, and both tend to produce "black markets".

2) Price ceilings reduce the quantity of a good which is purchased legally in a market, and price floors do the same thing.

3) The minimum wage law is an example of a price floor, and rent controls is an example of a price ceiling.

Then choose which of the following is most accurate:

| A. |

Only Statement 1 is true. |

| B. |

Only Statement 2 is true. |

| C. |

Only Statement 3 is true. |

| D. |

1, 2 and 3 are all true. |

| E. |

None of 1, 2 or 3 are true. |

|

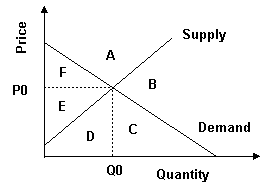

Reference: Figure 4-19

| 19. |

(Repeat answer on Scantron lines 43 and 44.) Refer to the graph above. When quantity supplied equals quantity demanded, producer surplus is:

| C. |

area C plus area D plus area E. |

|

| 20. |

(Repeat answer on Scantron lines 45 and 46.) The formula for calculating price elasticity of demand is:

| A. |

the change in quantity demanded divided by the change in price. |

| B. |

the percentage change in quantity demanded divided by percentage change in price. |

| C. |

the change in price divided by the change in quantity. |

| D. |

the percentage change in price divided by the percentage change in quantity. |

|

| 21. |

(Repeat answer on Scantron line 47.) If the price elasticity of demand equals 1.5 and the price elasticity of supply equals .5 then:

1) The sellers bear 25% of the burden.

2) The buyers bear 25% of the burden.

3) The sellers bear 75% of the burden.

4) The buyers bear 75% of the burden.

5) The buyers bear 1/3 of the burdent.

| A. |

Only statements 2 and 3 are correct. |

| B. |

Only statements 1 and 4 are correct. |

| C. |

None of the statements are correct. |

| D. |

Only statement 5 is correct. |

| E. |

Only statements 1 and 5 are correct. |

|

| 22. |

If you want taxes to be as efficient as possible:

| A. |

place large taxes on just a few goods rather than small taxes on many goods. |

| B. |

tax efficiency is not influenced by price elasticities of demand or supply. |

| C. |

tax a good which has steap supply AND demand curves. |

| D. |

tax a good which has price elasticities of supply and demand which are as large as possible. |

| E. |

tax a good which has flat supply AND demand curves. |

|

| 23. |

(Repeat answer on Scantron lines 48 and 49.) Evaluate these statements and choose the best answer.

1) As a general rule, the more substitutes a good has, the less elastic is its demand curve.

2) As a general rule, the more important a good is in the buyers' budgets, the more elastic is its demand curve.

| A. |

Only statement 1 is true. |

| B. |

Only statement 2 is true. |

| C. |

Both statements are true |

| D. |

No other statement is true. |

|

| 24. |

(Repeat answer on Scantron line 50.) Consider the following statements and then choose the best answer.

1) If the price elasticity of demand equals 2, a reduction in price will increase total revenue from sales.

2) If the price elasticity of demand equals 1/2, a reduction in price will reduce total revenue from sales.

3) If the price elasticity of demand equals 1, a reduction in price will leave total revenue from sales unchanged.

4) Total revenue from sales depends on the elasticity of supply, not the elasticity of demand.

| A. |

None of statements 1, 2 or 3 are correct. |

| B. |

Only statement 3 is correct. |

| C. |

Only statements 1 and 2 are correct. |

| D. |

Only statements 1, 2 and 3 are correct. |

| E. |

Only statement 4 is correct. |

|

Answer Key

| 1. |

A

|

| 2. |

A

|

| 3. |

A

|

| 4. |

B

|

| 5. |

B

|

| 6. |

D

|

| 7. |

B

|

| 8. |

A

|

| 9. |

E

|

| 10. |

A

|

| 11. |

B

|

| 12. |

C

|

| 13. |

D

|

| 14. |

B

|

| 15. |

C

|

| 16. |

D

|

| 17. |

B

|

| 18. |

D

|

| 19. |

B

|

| 20. |

B

|

| 21. |

A

|

| 22. |

C

|

| 23. |

B

|

| 24. |

D

|