The Financial Aid Office may request additional documents to process your application. If additional documents are needed, you will be notified via your ACCMail. You can also track your status in Self-Service. To prevent delays, submit any required documents as soon as possible.

How to Submit Financial Aid Forms Online

- Log in to your Self-Service portal (ACCeID and password required).

- Select “Financial Aid.”

- Choose the appropriate school year from the drop-down menu.

- Scroll down to the “Checklist” and select “Complete required documents”.

- You’ll see a list of forms you need to fill out. Remember to only submit the ones requested.

- Click the link for “Missing Documents,” and you will be directed to a StudentForms portal where you can easily fill out and upload the required documents online.

- Returning user – You will be automatically signed into StudentForms with your ACCeID and password.

- New users – You will be prompted to create an account before you can access StudentForms (see below).

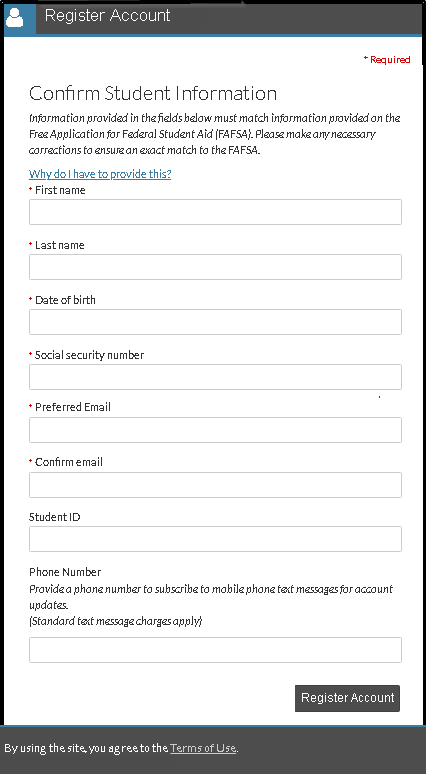

Creating a StudentForms Account

First-time users must create a StudentForms account before they can submit or upload missing documents online. Once your account is set up, you can log in using your ACCeID and password.

Please follow the steps below to create your account.

- Log in to StudentForms.

- Enter your information. Your information must match what you put on the FAFSA. Use your ACCMail account as the email address ([email protected]).

- If you do not have a Social Security Number (SSN), use your ACCeID with “00” in front (e.g. if your ACCeID is 1111111, use 001111111 to create your account).

- Select “Register Account” to create your account. Your ACCeID and password will serve as your credentials for all future sessions.

Electronic Signatures (Student & Parent)

Students and parents can electronically sign required documents through StudentForms. Follow the on-screen instructions for each form to request a parent’s signature. If applicable, your parent will be sent email instructions to create their StudentForms account and sign documents electronically.

NOTE: Your parent should save their login information so they can access StudentForms in the future. If needed, they may also use the same account to sign financial aid forms for their other children at ACC.

Texas Application for State Financial Aid (TASFA) Forms

Please visit our TASFA website for instructions on how to apply. Additional documents may be required after you submit your application. Any requested documents can be submitted via StudentForms (see above).

Back to Top